The Cleantech Venture Network this week

released their Q3 tally of sectoral investments, and it was another banner quarter. Almost a billion dollars of investments were tracked by the group in North America, and including European figures it topped the $1B mark.

Interestingly, out of 47 deals tracked in North America, five deals (Cilion, Altra, Ion America, Renewable Energy Group, and Newmarket Co.) made up 60% of the total funds invested. It's a very good indication of what

we've talked about before, in that there is a bit of blurring of project finance and traditional VC in the market figures, especially when it comes to biofuels.

Cilion,

Altra,

REG and

Newmarket raised their large financings in order to build out or acquire new production facilities... This has implications when thinking about the importance of cleantech within the overall VC industry. The press release points out that the dollars tracked in cleantech was 14% of overall VC investment in the quarter, but that the number of deals tracked was 5% of the overall total VC dealflow. Perhaps the latter figure is a good way to think about the positioning of the sector right now.

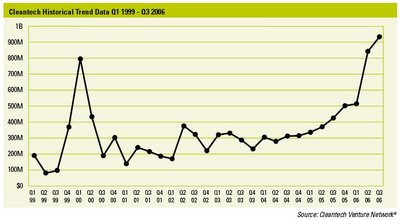

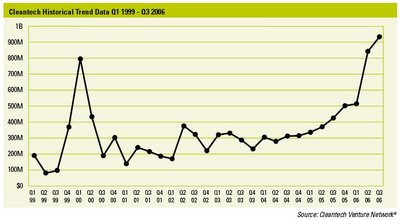

Note in the PR that the language is a bit confusing when it states that "Cleantech investment YTD is running 20% behind last year YTD," which apparently actually relates only to European investment totals, according to Craig Cuddeback at CTVN. As the below chart shows, it was actually another up quarter for the sector in North America.

One deal to note: A sensor company, Visyx,

has been spawned by Symyx with most of the funding coming from CMEA. The sensors will be targeted initially at monitoring of fluids in transportation applications. Symyx received 37% of the new company in exchange for $400k in cash and the contribution of IP.

Other news and notes:

Surveyed cleantech companies expect the AIM to be "more important" than the NASDAQ for the sector -- but does this really imply that AIM is becoming the exit path of choice? The press storyline regarding AIM vs NASDAQ is picking up on the SarbOx obstacles in the US, but the other factor is that such comparisons may not be apples to apples. In many cases, such go-public moves are less of an exit for venture investors than an alternative way to enable follow-on financings from public investors, but with

too little float to allow real liquidity for major shareholders. That financing alternative is an important role, but it does mean that comparing NASDAQ to AIM or other exchanges -- without differentiating between the big cap and small cap exchanges they manage -- is a bit tricky.

Here's an article on the subject from a while back. It would be interesting to do another similar survey, but also asking specifically about the role of each exchange for investors' exits and returns (and also it would be nice to ask a broader set of interviewees than those attending a single conference in London)...

Also: Israel has an

"immediate need" for $210mm of cleantech VC and private equity funds... Neal concludes that cellulosic ethanol

might be making progress, but "the jury is still out"... Why is energy storage getting such strong interest from investors? Among other reasons,

$74B is an attractive target market size (note: sub. req'd)...

Even Matt Marshall would have to admit that

there's an impressive cleantech cluster in the Boston area...

No, Joel, it probably can't -- but that's one reason

it remains a very attractive investment area. So it's not a bad thing... Finally,

more info on

the recent Zipcar financing.